Partnering with foundations, endowments and not-for-profits since 1994.

Burgundy’s Core Elements

Our Clients

We build relationships with foundations, endowments and not-for-profits that share our investment philosophy and long-term view, and are looking for an independent investment manager with a strong track record of investing globally.

We understand that foundations, endowments and not-for-profit organizations are stewards of capital that must be managed, sustained and grown over the long term. As discretionary investment managers and fiduciaries, we share your commitment to put the interests of the organization and its stakeholders first.

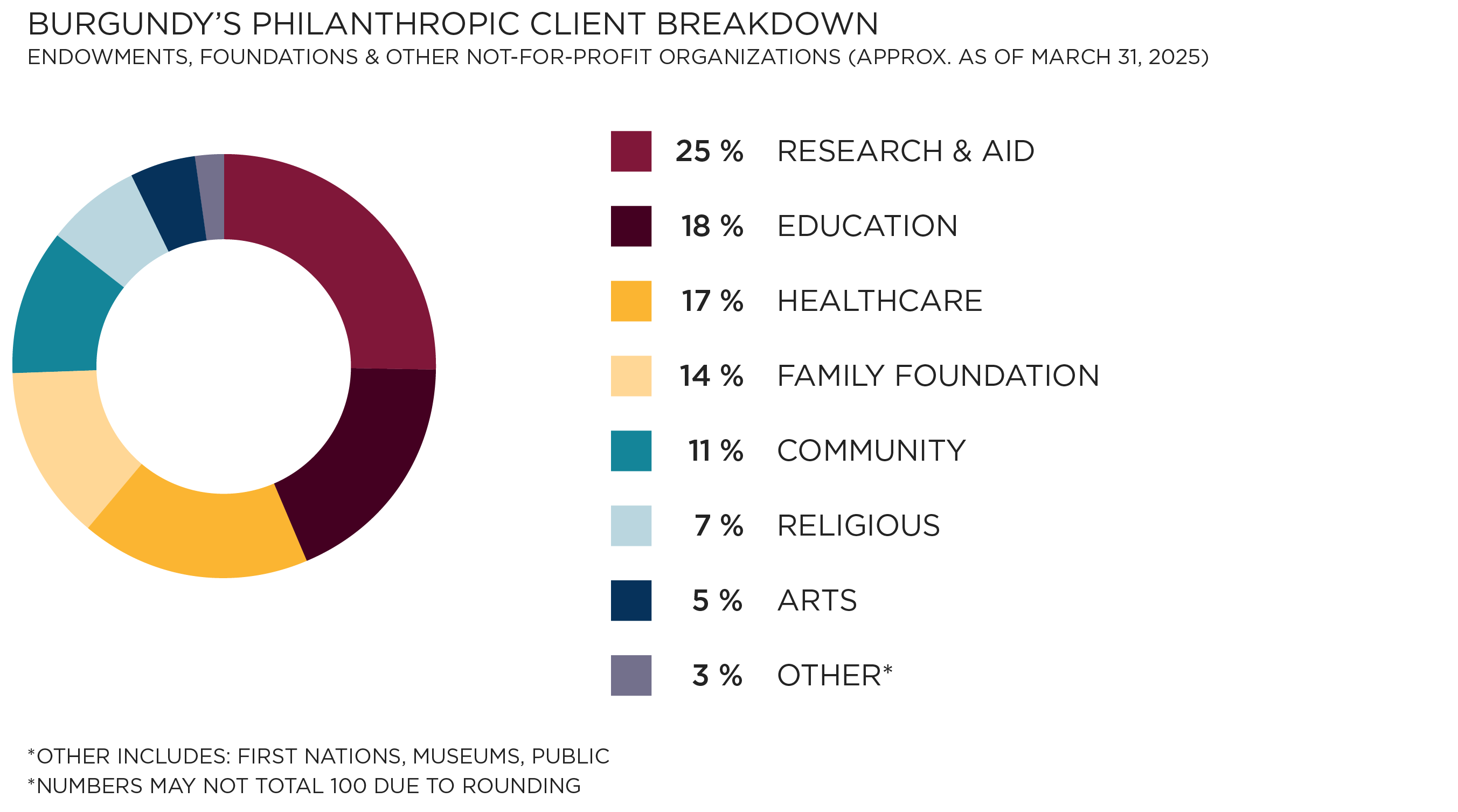

We manage assets for approximately 200 not-for-profit clients throughout Canada and internationally (as of December 2024) and our diverse clients include some of the 50 largest foundations and endowments in North America.

Our investment philosophy of long-term, quality/value investing is appropriate for foundations, endowments and not-for-profit organizations seeking a combination of capital preservation, growth and income. We work directly with you to meet a specific investment need, or to devise a customized investment strategy that meets the overall investment objectives of the organization.

As a client of Burgundy, there is no intermediary. You have a direct relationship with the people who make investment decisions on your behalf, as well as a dedicated relationship and account management team.

Each quarter you receive customized Portfolio Manager commentary providing market perspectives and highlighting how Burgundy’s investment philosophy is implemented.

You also have opportunities to meet with your Burgundy team regularly to review performance results and overall portfolio positioning.

Contact us to learn more

Kyle Coatsworth, CFA

Vice President, Head of Institutional

What We Do

BURGUNDY’S INVESTMENT APPROACH

We follow a quality/value investment approach to preserve and grow our clients’ capital over the long term. Our rigorous research process is bottom-up and fundamental in nature, focusing on long-term company theses rather than short-term catalysts or macro events. Portfolios are concentrated and benchmark agnostic.

Quality/value investing is based on investing in great companies when we can buy them for less than they are worth and holding them for the long term.

We combine quantitative and qualitative research, along with experience and human judgment, to assess each company’s business characteristics, financial position and management team. Intensive research into individual companies and their management is the critical process that supports our investment decisions.

The value of an investment opportunity comes from the quality of a company’s business and the price we are willing to pay for it.

Our investment approach is based on proprietary research. Travel has always been a key component of Burgundy’s advantage, with company management meetings and on-site tours helping to drive independent thought and unique insights. Taking a long-term view is also a key factor.

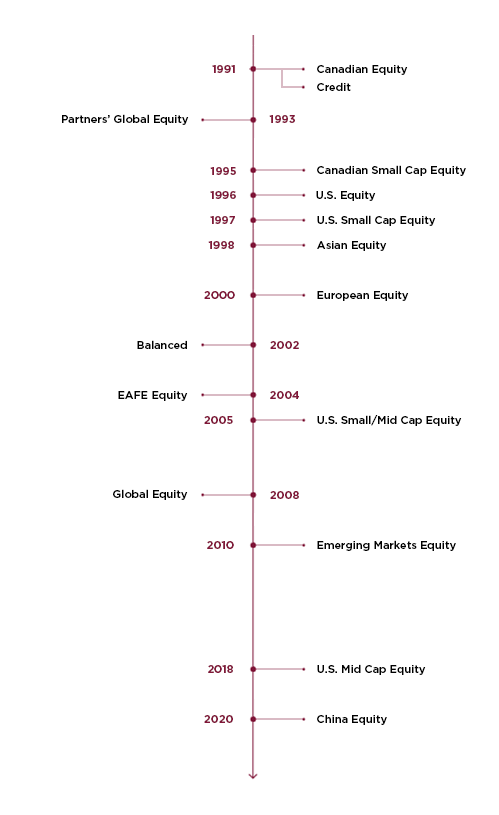

Our Investment Team has built a deep understanding of investment opportunities in equities and credit. Over the years, we have developed skills progressively, region by region:

MORE ABOUT INVESTING WITH BURGUNDY

INVESTMENT STRATEGIES

An overview of our offerings for equity, balanced and credit.

SUSTAINABLE INVESTING

Our disciplined, bottom-up approach allows us to identify and assess ESG factors that are material to the long-term value of the companies we evaluate.

ACTIVE INVESTING

As benchmark-agnostic active managers, our strategies have never resembled their respective benchmarks. Typical active share across the Burgundy strategies is 85% or greater.

The Team

An organization is built and strengthened by the quality and calibre of its people.

Independence & Experience

TAKING A LONG-TERM VIEW

We are committed to remaining a private firm, owned by our key people. A private ownership structure fosters stability, accountability and a long-term view that can be difficult to achieve in a larger corporate structure or in a public company.

More than three-quarters of our people are owners of the firm, which affords us the opportunity to make decisions with the long term in mind and in the best interest of our clients.

Having complete control of resources keeps our focus on investment research and client service. Clients remain at the centre of all decisions. We prioritize existing clients, managing growth and closing mandates when warranted.

The Burgundy Investment Team brings extensive knowledge and decades of experience. As generalists organized by geography, we draw on the experience of our colleagues. Idea sharing and collaboration are a daily occurrence; members benefit from the collective wisdom of the team across industries, sectors and broad markets.

Our depth of experience helps build the capacity to make tough investment decisions. The right and hardest decisions are often the same – a lesson that team members have lived time and time again.

Experience also affords us the space for humility. When faced with a problem or a new way of thinking, we are able to step back, question, analyze all angles, and either proceed with renewed conviction or learn from the exercise and adapt. It is this balance of conviction and humility that exists at the centre of a learning organization.

Our core values – Always Act in our Clients’ Best Interests, Courage and Honesty – guide us to do the right thing. In our case, doing the right thing means doing right by our clients.

The Burgundy Community

A defining aspect of your relationship with Burgundy, our community offers the opportunity to learn from and connect with us and your peers throughout the year. We place a considerable emphasis on education because it is an essential component of long-term investment success.

Events

Connect with the community at annual events like the Forum and Burgundy Ball.

Views & Insights

Dive into the minds of the people making investment decisions on your behalf.

Women of Burgundy

Foster curiosity and confidence by choosing to make investing a priority.

Meet With Us

A meeting with Burgundy is a two-way discovery session. As we learn more about your organization’s needs and objectives, you have the opportunity to speak with us directly to learn more about Burgundy, our investment strategies and how we think. Connect with us today.