David Vanderwood, CFA

Senior Vice President, Portfolio Manager

Area of Focus

- Canadian equities

David bought his first stock in 1979 when he was 11. Although he backed up the truck and “averaged down” three years later, the company went bankrupt. That painful experience inspired David to dedicate his professional life to developing an understanding of how to be a successful investor. The fact that this ambition is a never-ending work in progress is one of the things David loves about investing.

Burgundy Experience

- Joined Burgundy in 2001

- Appointed a Senior Vice President in 2003

Relevant Experience

- 30+ years of combined professional experience

- Experience includes positions at: Odlum Brown Ltd., UBC Portfolio Management Foundation

Education

- CFA charterholder

- Honours Bachelor of Commerce (Finance), University of British Columbia

Memberships and Community

- Member, CFA Society Toronto

- Member, CFA Institute

POSTS FROM THIS AUTHOR

3 for 30

The View | February 2024

Can you distill a three-decade career down to three essential lessons? On the heels of his 30th anniversary, Portfolio Manager David Vanderwood is up to the challenge....

Disagreeable Me

The View | July 2022

In a world that begs we take a consensus view, taking the road less travelled can be an uncomfortable choice socially and spiritually. In this View from Burgundy, Portfolio Manager...

a-b-c-d-ESG

The View | November 2021

In this latest View from Burgundy, Canadian equities Portfolio Manager David Vanderwood advocates for the importance of considering trade-offs when solving complex problems, as he explores the ongoing...

Not the Time to Sell

The View | December 2015

Suncor Energy Inc. (Suncor) announced a hostile offer to buy all of the outstanding shares of Canadian Oil Sands Limited (COS) on October 5, 2015. As the owner on behalf of our...

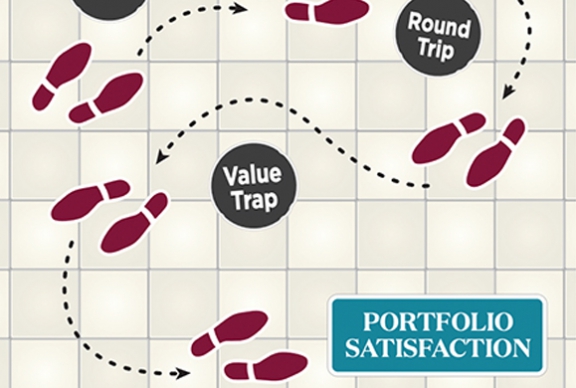

Ain’t Misbehavin’

The View | October 2015

Value investing is simple: buy stocks when they are trading for less than their intrinsic value. But simple doesn’t mean easy. There are many roadblocks standing in the way...

Stoicism and the Art of Portfolio Intervention

The View | February 2013

Warren Buffett and other successful quality/value investors have given us a capital compounding system that works. But few follow the program. In this issue of The View from Burgundy,...

An Investment Lesson from Warren Buffett

The View | April 2012

People often approach investments without first understanding what they are trying to achieve. Many end up with poor long-term returns and even more confused than when they started. Warren Buffett,...

The Most Valuable Option of All

The View | January 2011

Financial options were designed to help investors maximize upside exposure while limiting the downside. In this View from Burgundy, we look at how investments that closely resemble financial options c...

Reflections from the Funhouse

The View | May 2007

Top corporate managers and elite investors both specialize in capital allocation. Whether in the corporate sector or in securities investments, the most successful capital allocators follow some surpr...

Avoid the Coming Oil Slick

The View | June 2006

The world is seeing an incredible commodities boom. You might be wondering if Burgundy is missing the gold rush. I am here to tell you that nothing could be further...

Requiem for a Brewer

The View | December 2004

In early 2002, Molson Inc., one of Canada’s grand old companies, appeared to have shaken off a history of poor decisions and positioned itself for a bright future. Under the...

The Eighth Wonder

The View | February 2004

On a cold Montreal day in February 2000 at BCE Inc. headquarters, Jean Monty was making a tough decision. As head of the dominant local telephone company in eastern Canada, Mr....

Horse Sense

The View | January 2003

Jim Grant, the editor of Grant’s Interest Rate Observer and guest speaker at Burgundy’s 2000 Client Day, once wrote in a typically elegant formulation that “the tricky thing about...