Investment Strategies

FOR INSTITUTIONS

Global Equity Foundation at a Glance

Year Launched

2018

Geography

• Global equities

• Max. 15% in emerging markets

Market Cap

Min. US$3 billion at initial purchase

Number of Holdings

Concentrated: 35-75

FOUNDATION SERIES

Invested according to Burgundy’s Responsible Investment Policy, which excludes companies directly producing tobacco, armaments and cannabis, as well as gambling-related companies.

Portfolio Breakdown

Concentrated: 35-75

86%

Average Annual Turnover

17%

Position Sizing

Maximum 10% of market value in any one company

Sector Limits

Maximum 40% of market value in any one sector

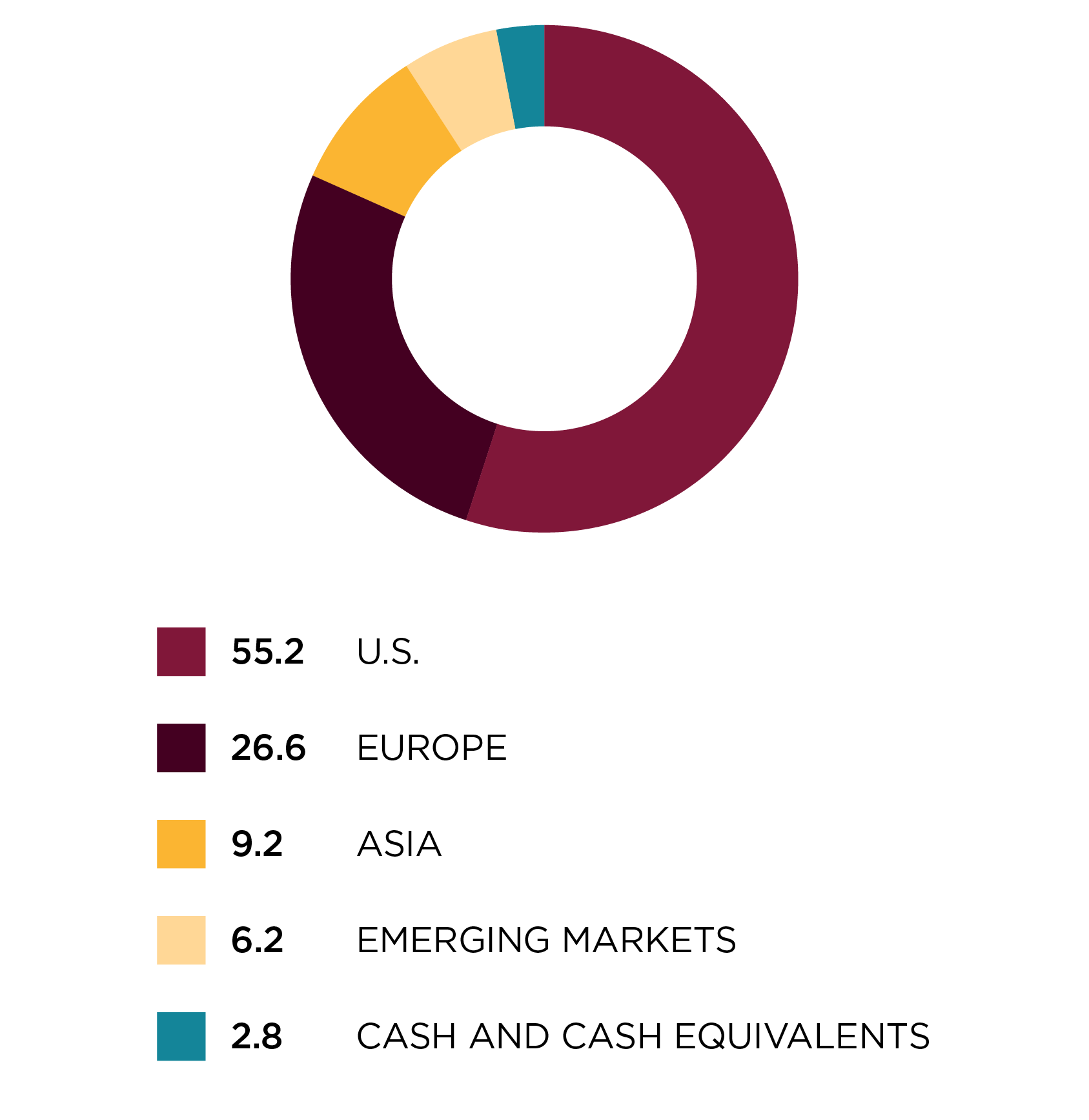

Regional Allocation

As at December 31, 2023.

Active Share

Active share measures the degree to which a fund differs from its respective benchmark — the higher the active share, the lower the fund’s correlation to its benchmark (100 being completely different from the benchmark and zero being a replica of the benchmark).

Active share is calculated for the Burgundy Global Equity Foundation Fund vs. the MSCI ACWI Index. Source: FactSet.

Average Annual Turnover

10-year average annual turnover is calculated using full calendar year portfolio turnover figures only. Partial inception year turnover figures are also excluded from the calculation, where applicable. Newer strategies are calculated since inception.

Portfolio Manager

KENNETH BROEKAERT, CFA

SENIOR VICE PRESIDENT, PORTFOLIO MANAGER

- Joined Burgundy in 2003

- 25+ years of combined professional experience

Learn More

Investment Team

Burgundy’s Investment Team consists of decentralized, autonomous, regional teams working in a unified, collaborative, idea-sharing environment in Toronto, Canada.

The Team concentrates on bottom-up fundamental research, frequently travelling around the world to study companies up close and meet with management teams face-to-face.

14

Portfolio Managers

14

Investment Analysts

23

Average PM Years Experience

Contact us to learn more

KYLE COATSWORTH, CFA

VICE PRESIDENT, HEAD OF INSTITUTIONAL